Quantum Ai:

Quantum Ai: Your Gateway to Crypto Education

Sign up now

Sign up now

Quantum Ai is set up as an access point, not a learning destination. Many people look for investment education and struggle to find where real discussions begin. The site addresses that gap by organizing introductions to independent educational firms. Nothing is taught on the site itself. No guidance appears. The function stays limited and clear. Open the door. Step back.

Connection starts with registration. Users enter a full name, an email address, and a phone number. Those details allow educators to respond directly and explain how their educational discussions work. Topics, depth, and formats vary by educator. No sorting takes place. No preference appears. It feels like requesting a meeting, not enrolling in a class. The next step depends on conversation, not automation.

Education accessed through these connections helps people place ideas in order. It supports clearer thinking, not certainty. Risk remains part of markets. Outcomes stay uncertain. Research still matters. Comparing viewpoints still matters. Speaking with qualified financial professionals before decisions supports balance. What topics feel unclear right now? Which areas deserve slower review? Cryptocurrency markets are highly volatile and losses may occur.

Registration exists to open a clear line of contact. Nothing more. Many arrive with questions and no place to start. The site keeps the entry simple so conversations can begin without friction. No lessons appear during sign up. No views are shared. The step focuses on access and direction. It feels like filling out a name card at an event. Small action. Useful outcome.

The process asks for three details only. A full name. An email address. A phone number. Each serves a purpose. The name helps identify the request. The email supports written replies. The phone number allows follow up when needed. Educational firms use this information to explain learning formats or subject areas. Nothing gets filtered. No ranking occurs. Curiosity drives the exchange. Research habits still matter. Speaking with qualified financial educators before decisions supports balance. What questions feel unanswered right now?

Educational material does not come with conclusions attached. What people receive through connections depends on the educator and the topic discussed. Markets remain uncertain. Reactions change fast. Learning material helps people slow down and observe, not arrive at fixed answers. Use of education stays personal. Some reflect quietly. Others take notes. Confusion often appears first, then fades with time. That early confusion signals learning has started. Cryptocurrency markets are highly volatile and losses may occur.

The site handles logistics only. When someone registers, basic contact details move through a simple system. A name identifies interest. An email supports replies. A phone number allows follow up. That is where involvement ends. No material is stored. No opinions are shared. No conversations are shaped. Once contact begins, the system steps back and remains silent.

Educational material often explains how markets respond across different phases. Topics may include why prices react sharply to headlines, how momentum fades, or why quiet periods matter. Past market events are used as reference points to explain behaviour, not to suggest actions. Learners often apply this material by comparing present activity with earlier periods and noting differences rather than similarities.

Some learning focuses on observation habits. These materials discuss how attention shifts, how narratives form, and why repetition appears across cycles. Learners often use this by reducing reaction speed, writing down observations, or reviewing explanations after market moves settle. Some learning focuses on observation habits. These materials discuss how attention shifts, how narratives form, and why repetition appears across cycles. Learners often use this by reducing reaction speed, writing down observations, or reviewing explanations after market moves settle.

Educational material does not tell anyone what to do next. It does not remove uncertainty or prevent mistakes. Its value depends on how it is reviewed and questioned. Comparing viewpoints helps widen perspective. Independent research remains useful. Speaking with qualified financial educators before decisions supports balance.

New investors often react to price movement first. Headlines feel urgent. Every move looks meaningful. Educated investors read price action with distance. Short moves get filtered out. Attention stays on structure, not speed. Experience teaches that markets speak in phases, not bursts. It feels like hearing a loud sound and learning when it matters and when it does not.

New investors often link movement with action. A rise feels like a signal. A drop feels like danger. Educated investors separate movement from meaning. Context matters more than direction. Larger timeframes shrink panic. Past events shape interpretation. Risk still exists, yet reactions slow. Calm decisions come from understanding how often markets exaggerate.

New investors focus on outcomes. Wins feel validating. Losses feel personal. Educated investors watch behaviour instead. Fear near lows. Confidence near highs. These patterns repeat across decades. Charts from different eras show similar emotional waves. Asking why behaviour repeats builds awareness. Guessing timing matters less than recognizing rhythm.

New investors often stop learning once action begins. Educated investors continue observing. Review stays constant. Comparing periods builds clarity. Research deepens over time. Conversations with qualified financial professionals help test ideas. Learning feels less like chasing answers and more like adjusting a lens until the picture sharpens.

New investors treat headlines as instructions. Each update feels urgent. Educated investors place information into order. One data point rarely stands alone. Events link across time. Structure slows reactions. Noise fades when context grows. Education does not promise results. It improves understanding by showing how pieces fit together.

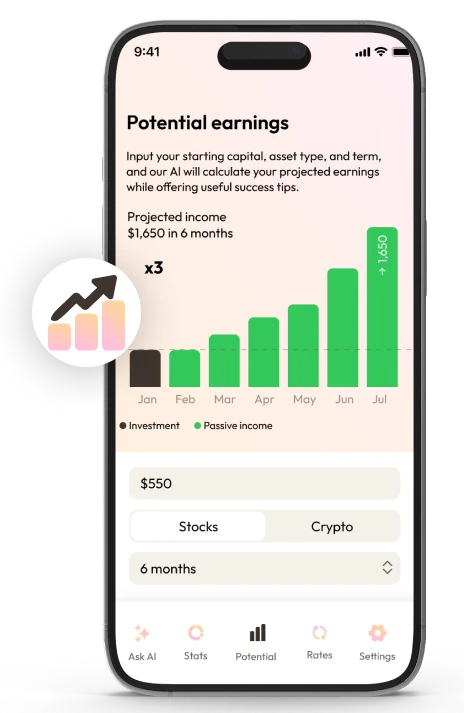

Investment education helps reveal how different market elements influence each other over time.

Price rarely moves alone. Volume, participation, and sentiment often shift together. Markets pause, then accelerate, then pause again. Past cycles show these patterns repeating in new forms.

Education highlights how quieter periods often appear before attention returns. It feels like noticing the pause between waves rather than watching only the splash. This perspective supports calmer observation and helps learners place short movements within a wider, connected picture.

Educational material often begins with broad explanations. These focus on how markets function, why prices move, and how participants react over time.

This material helps build a base layer of understanding. Many first encounter market history, basic terminology, and common patterns. It feels like learning the rules of a game before watching it played.

Some educational discussions focus on context rather than facts. These materials explain why similar events produce different outcomes in different periods. For example, interest rate changes in 2008 carried different effects than similar changes in 2022. Learners use this material to compare situations instead of assuming repetition. Context helps slow reactions.

Another type of material looks at recurring behaviour. Fear near drops. Confidence near highs. These discussions use charts and timelines to highlight repetition across decades. Learners often use this material to recognise emotional phases rather than predict price levels. Awareness grows by spotting rhythm, not timing.

Some education centers on limits. These materials explain what education cannot do. Markets remain uncertain. External events disrupt plans. Learning here focuses on framing risk and understanding uncertainty. This material helps learners avoid overconfidence. It’s like learning where the edge of the map ends instead of assuming the road continues.

Other material encourages reflection. Reviewing past periods. Comparing viewpoints. Revisiting explanations after market moves settle. This type of education supports long term understanding. Learners often journal observations or revisit material later. Speaking with qualified financial professionals before decisions supports balance. Cryptocurrency markets are highly volatile and losses may occur.

Investment education often becomes useful when expectations run ahead of reality.

Many assume markets reward effort quickly. History suggests otherwise. Periods like 2000, 2008, and 2022 show long stretches where patience mattered more than prediction.

Education helped some recognise that waiting is part of the process. It did not remove disappointment. It helped explain why progress often looks uneven before it looks clear.

Market activity often gives subtle clues before larger changes appear. Activity may slow. Trading ranges may narrow. Participation may thin out. Education discussions help explain why these conditions matter without assigning meaning too early. Short pauses often come before stronger moves, yet not every pause leads to change. Learning encourages steady observation instead of fast conclusions.

Quantum Ai supports access to these discussions by connecting individuals seeking investment education with independent educators. Through these connections, people explore how market behaviour is commonly analysed and discussed across different conditions. Registration allows this contact to begin. Communication stays simple and direct.

A full name, email address, and phone number allow educators to respond. No learning material appears during registration. No viewpoints are shared. The process exists only to open dialogue, leaving interpretation and decisions with the individual.

Quantum Ai does not influence how markets behave. Policy changes, capital movement, sentiment shifts, and unexpected events continue to drive outcomes. The site focuses on access rather than instruction. It helps individuals reach educational firms without adding pressure or direction. This separation allows learning conversations to begin without urgency.

During sharp market movements, interest in education often increases. Many search for explanations before understanding the right questions. Quantum Ai supports slower entry into learning by keeping the process organised. Registration opens contact. Nothing else. No material appears. No opinions are introduced. Conversations take place outside the site.

Learning works best when information arrives at a steady rhythm. Fast exposure often overwhelms new learners. Slower pacing helps ideas settle and connect.

Looking back at 2008 or 2022 shows how rushed reactions increased confusion. Education supports spacing concepts over time so patterns become visible. It feels like letting fog lift instead of driving faster through it. Calm reveals more than speed.

Trading education helps learners understand how price moves form over time. Markets rarely move in straight lines. They pause. They accelerate. They reverse. Education explains why these shifts happen and how traders often react too quickly. Looking at past periods like 2017 or 2021 shows how excitement often peaks before structure weakens. It feels like learning to read traffic patterns instead of reacting to every honk.

Education around trading often focuses on timing awareness rather than signals. Short moves can look dramatic when viewed alone. Inside larger timeframes, they appear smaller. Learning helps place entries and exits into context. This perspective reduces impulsive reactions during fast candles. Better timing begins with understanding when not to act.

Trading behavior repeats because human behavior repeats. Fear appears near drops. Confidence grows near highs. Education highlights these recurring phases across years like 2008, 2020, and 2022. Patterns do not guarantee outcomes. They offer reference points. Learning helps spot similarities without assuming repetition will play out the same way.

Education improves when traders review past decisions calmly. Revisiting entries, exits, and missed setups helps connect action with outcome. Comparing different approaches adds perspective. Independent research remains useful. Asking clear questions sharpens understanding. Speaking with qualified financial professionals before decisions supports balance. Many traders learn more from one review session than ten new charts.

Trading education works best when roles stay clear. Educators explain structure and behavior. Learners evaluate and apply ideas carefully. Sharing only necessary information keeps discussions focused. Reading explanations fully reduces confusion.

Asking questions prevents assumptions. Learning grows when expectations stay realistic and boundaries remain clear.

After registration, contact details enter a simple routing process. A full name, email address, and phone number help direct interest to suitable educational firms. Those firms may respond with information about how their learning discussions work. No material appears on the site. No steps or guidance show up. It feels closer to requesting an introduction than signing up for a course. The next move depends on conversation.

Doubt remains part of all markets. Education helps place information into context rather than remove uncertainty. Learning often explains how price, timing, and behaviour interact across periods. This awareness supports slower interpretation when markets move fast. History shows uncertainty changes shape but never disappears. Education supports clearer limits, not certainty.

Quantum Ai limits its role to coordination so expectations remain clear. Teaching happens elsewhere. Evaluation stays personal. This separation helps conversations stay focused on learning rather than outcomes. Research remains essential. Comparing ideas adds perspective. Speaking with qualified financial professionals before decisions supports balance. Cryptocurrency markets are highly volatile and losses may occur.

| 🤖 Joining Cost | No fees for registration |

| 💰 Operational Fees | No costs whatsoever |

| 📋 Registration Simplicity | Registration is quick and uncomplicated |

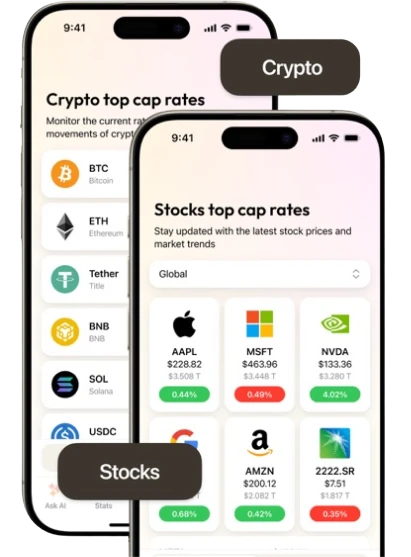

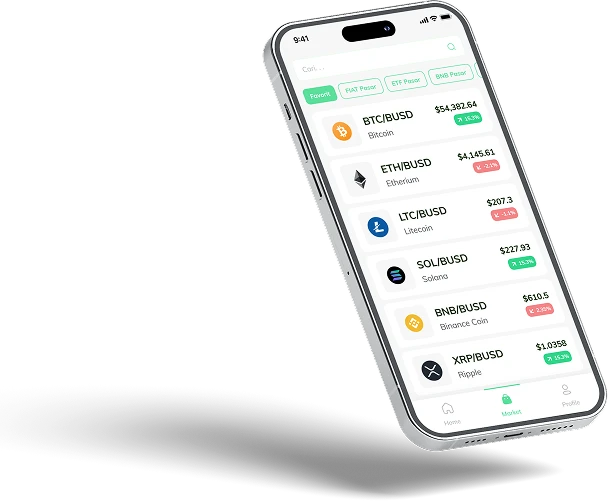

| 📊 Focus of Education | Lessons on Cryptocurrencies, Forex Trading, and Investments |

| 🌎 Countries Covered | Excludes the USA, covers most other countries |